does wyoming have taxes

Up to 25 cash back As just mentioned Wyoming is one of just a few states that have neither a corporate income tax nor a personal income tax. Herschler Building 2nd Floor West.

Aisha Balogun From Nigeria Graduated From The University Of Wyoming With A Major In Computer Engineering And Minor Video In 2021 Wyoming Wyoming Travel Road Trips Blockchain

Wyoming does have an excise tax on beer but it is extremely low.

. See the publications section for more information. Household assets other than your house a car for each adult household member and IRA and other pension funds worth less than 133651 per adult household member. Wyoming does not have its own income tax which means the state will not tax any form of retirement income.

Up to 25 cash back Here are the basic rules on Wyoming state income tax withholding for employees. At just 2 cents per gallon it is the lowest beer tax in the country. State wide sales tax is 4.

Note that Washington does levy a state capital. At 4 the states sales tax is one of the lowest of any state with a sales tax though counties can charge an additional rate of up to 2. This includes Social Security retirement benefits.

If the holding company owns property in Wyoming the company should expect to pay property taxes at the following rates. Property taxes and sales taxes in Wyoming are also among the lowest in the country. Wyoming has no state income tax.

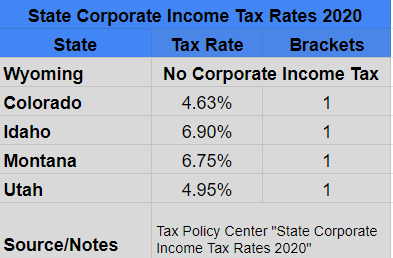

Wyoming Internet Filing System WYIFS The following are from this page. The state prides itself on being a place where people that fosters real estate transactions. In addition to having no personal income tax Wyoming also collects no state income tax on corporate income or receipts.

Overview Of Wyoming Taxes. Texass severance tax made up 6 percent of its FY2014 revenues while its property taxes made up more than 40 percent. Wyomings corporate income tax is a business tax levied on the gross taxable income of most businesses and corporations registered or doing business in Wyoming.

However you will still need to withhold. Wyoming does not have an individual income tax. It does collect a state sales tax and counties have the option of adding an additional 1 to the state levy.

Wyoming has a 400 percent state sales tax a max local sales tax rate of 200 percent and an average combined state and local sales tax rate of 522 percent. Therefore if you have a small business with employees who work in Wyoming you wont need to withhold state income tax on their wages. However revenue lost to Wyoming by not having a personal income tax may be made up through other state-level taxes such as the Wyoming sales tax and the Wyoming property tax.

Household income less than the greater of 34 of the county or state median household income. In fact with the possible exception of South Dakota Wyoming may be the most income tax-friendly state in the country. Wyoming has one of the lowest median property tax rates in the United States with only eleven states collecting a lower median property tax than Wyoming.

Wyoming also does not have a corporate income tax. Property tax paid timely. The average total sales tax rate is 539 counting both state and local taxes.

As of 2021 Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming are the only states that do not levy a state income tax. Wyomings median income is 63602 per year so the median yearly. Tax amount varies by county.

Wyoming - Married Filing Jointly Tax Brackets. Similar to the personal income tax businesses must file a yearly tax. The median property tax in Wyoming is 058 of a propertys assesed fair market value as property tax per year.

According to the Tax Foundation if Wyoming had an excise tax instead of its current system it would be lowest excise tax in the country. But understanding the complexities surrounding Wyoming real estate tax laws can be overwhelming. Michigan has reciprocal agreements with Illinois Indiana Kentucky Minnesota Ohio and Wisconsin.

Submit exemption Form MI-W4 to your employer if you work in Michigan and live in any of these states. Both Wyomings tax brackets and the associated tax rates have not been changed since at least 2001. Wyoming actually doesnt have an income tax at all so any money you make in retirement including wages from a post-retirement job wont be taxed by the state.

Of the six states with significant mineral production surveyed by LSO only Wyoming and Texas assess property taxes on mineral holdings. Wyomings tax system ranks 1st overall on our 2022 State Business Tax Climate Index. There is no estate inheritance or gift tax in Wyoming.

Sales and Use Tax. Texas does not levy a severance tax on coal production but it does on oil and gas. The sales tax in Wyoming is also low.

Wyoming Department of Revenue. Wyoming also has low property taxes with an average effective rate of just 057. Wyoming has no state-level income taxes although the Federal income tax.

Wyoming Is Income Tax Free Wyoming is one of seven states with no personal income tax. Wyoming is one of seven states that do not collect a personal income tax. Property Tax is assessed at 115 for industrial property and assessed at 95.

Wyomings average effective property tax rate is also on the low side ranking as the 10th-lowest in the country. It has low sales and property taxes and theres no estate tax capital gains tax or state income tax. In addition Local and optional taxes can be assessed if approved by a vote of the citizens.

Wyoming is known for its real estate tax benefits. Each states tax code. Wyoming is 1 of only 9 states that do not tax individual wage income.

The Wyoming corporate income tax is the business equivalent of the Wyoming personal income tax and is based on a bracketed tax system. Unlike the large majority of other states Wyoming does not have a personal income tax. However Wyoming does have a property tax.

Resident of Wyoming for past 5 years.

Libertytax Of Casper Wyoming And Libertytax Of Riverton Wy Are Offering Free Tax Preparation For All Medical Personel W Tax Preparation Liberty Tax Tax Free

Taxes And Moving To A New State Moving To Another State Moving Retirement Income

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Wyoming Sales Tax Small Business Guide Truic

Wyoming Income Tax Calculator Smartasset

Which States Pay The Highest Taxes Business Tax Family Money Saving Economy Infographic

How Does Wyoming S Tax Structure Compare To Other States Wyofile

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Inc Ing The Deal A Lot Of Protection For Very Little Effort Effort Protection Lot

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 Retirement Income Retirement Best Places To Retire

Pin By Lawhorn Cpa Group Inc On Fun Fact Friday Fun Fact Friday Fun Facts Facts

The Most And Least Tax Friendly Us States

States That Won T Tax Your Retirement Distributions Income Tax Income Tax

Tax Benefits Of Buying A Home In Jackson Hole Wyoming Wyoming Home Buying Inheritance Tax

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

States With Highest And Lowest Sales Tax Rates

Want To Avoid High Taxes Retire In One Of These 10 States Retirement Money Choices Tax

Wyoming Income Tax Calculator Smartasset

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax States